A Permanent Account Number (PAN) is a distinctive 10-character alphanumeric code essential for conducting financial activities and filing taxes in India.

What is an E-PAN Card?

E-PAN is an electronic form (PDF) of the physical PAN Card, which is allocated (issued) by the IT (Income Tax) Department. The E-PAN card is kind of soft copy in PDF format of the PAN card, and you can use that PDF as a physical PAN card where it is required. The validity of an e-PAN card is similar to that of a physical PAN card, which is normally used by us.

How to Download E-PAN Card?

You can easily download an e-PAN card from the NSDL (Protean) , UTIITSL, and Income Tax e-filing portals. These are the main government authorized portals for PAN service.

“You need to know that which authorized portal assigned you the PAN number/card before, for first time, because if you want to download your e-PAN card PDF, it is required, such as the NSDL (National securities depository limited) portal, the UTIITSL (UTI infrastructure technology and services limited) portal, or the Income Tax e-filing portal”

1) Through NSDL Portal

If you applied for the PAN card originally on the NSDL (National securities depository limited) portal, you have to follow the process mentioned below to download e-PAN card PDF.

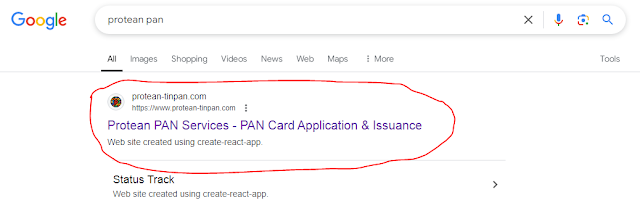

- Firstly, you have to visit the NSDL (Protean) official website or you can also search on Google “Protean PAN” and click on the first coming website. The link of the NSDL (Protean) portal is :- https://www.protean-tinpan.com/

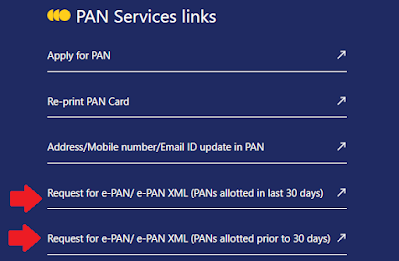

- On the main page of the website, find “PAN Services Links” and you will see two options to download e-PAN Card. PAN card allotted you in the last thirty days or PAN card allotted more than thirty days ago.

- Select the option as per your application date of your firstly applied PAN card.

“It depends on when portal/issuing agency assigned you the physical PAN card/number. If you got it within the last 30 days, click on the “in last 30 days” link to process the application. However, if your PAN card was allotted more than 30 days ago, click on the “prior to 30 days” link to download it.”

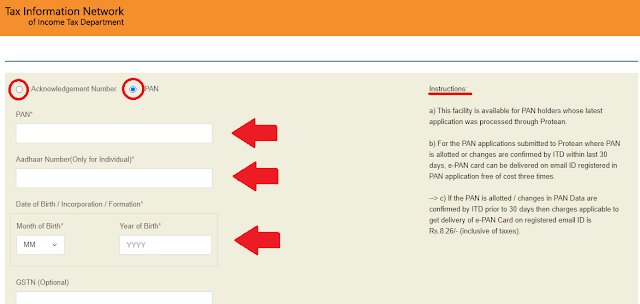

- First of all, you have to select the option from Acknowledgement and PAN. Fill the all details required to fill and then click on the “SUBMIT” button.

If you will be downloading your PAN card after the 30 days of allotment of your PAN. Then you will need to pay Rupees 8.26 (Incl. Taxes) for that. Also, your e-PAN PDF will by send by the portal automatically on your email ID linked with your PAN card in the records of NSDL.

You can also watch the video below to download e-PAN Card after 30 days of allotment.

Video Link : https://youtu.be/yBupPHkSplA?si=01IPQ5aoeTs1UxN2

2) Through UTIITSL Portal

If you originally applied for the PAN card through UTIITSL portal then you have to follow below mentioned process to download e-PAN card.

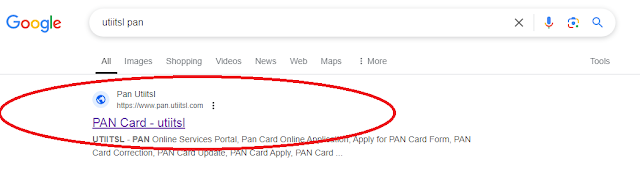

- Firstly, you have to visit on the UTIITSL official website or you can also search on Google “UTIITSL PAN” and click on the first coming website. The link of the UTIITSL portal is :- https://www.pan.utiitsl.com/

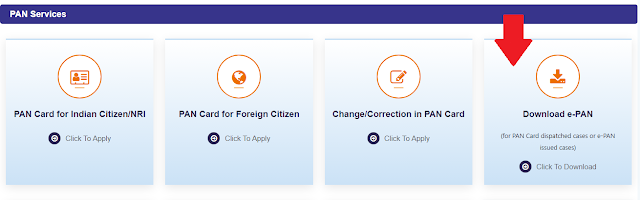

- On the main page of UTIITSL website, find the download e-PAN option and click on that option. You will be seamlessly go to the E-PAN card download page.

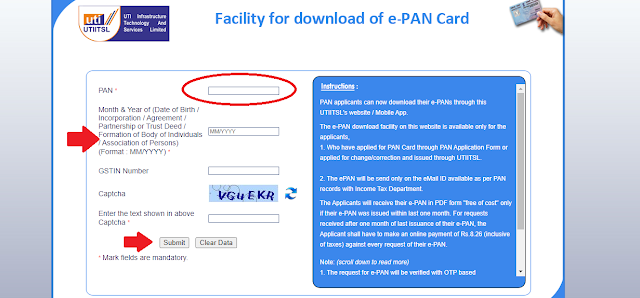

- On the E-PAN card download page, you have to submit your details like PAN number and month, year of your DOB (Date of birth). After submitting the details, you will get a link to your registered mobile number and email. You will be able to download the E-PAN card through that link.

Downloading e-PAN card from UTIITSL portal after 30 days of allotment will costs you Rupees 8.26 (Incl. taxes)

3) Download Instant e-PAN through e-Filing Portal

This is the best and easiest option to download e-PAN card but it can be used only, if you have originally applied PAN card here on E-filling portal of income tax. On e-filling portal of income tax you just have to put your Aadhaar number and submit a OTP, which you will get on your mobile number linked with Aadhaar card.

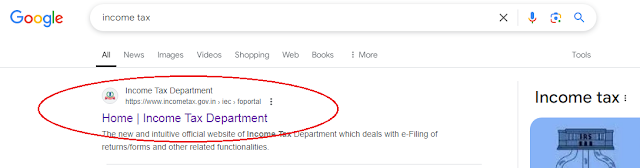

- Firstly, you have to visit on the Income Tax official website or you can also search on Google “Income Tax” and click on the first coming website. You can also directly click on given link to visit income tax portal :- https://www.incometax.gov.in/

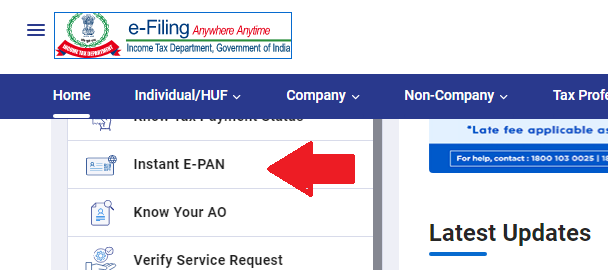

- Now on the left side of the main page of the Income Tax website, you will see an area called “Quick Links”. In that section you will see a option “Instant E-PAN“.

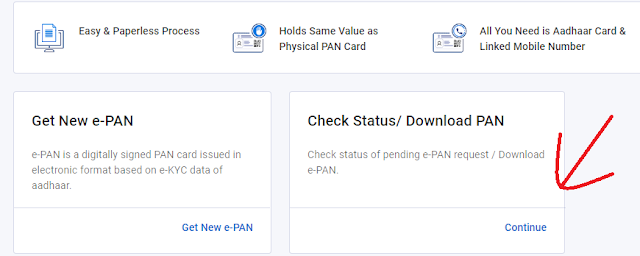

- In the quick links section, you have to click on the “Instant e-PAN” and after that you will see two buttons with different options on the page. The option first will be “Get New e-PAN” and the option second will be “Check Status/ Download PAN“. The second option is for to download e-PAN.

- Next, enter your Aadhaar card number and click continue. After that you have to enter the OTP and you will get the PDF of e-PAN card.

4) Password of e-PAN Card PDF

The E-PAN card PDF will be password-protected and can only be opened with your full DOB (Date of Birth), which means your complete date of birth, including date, month, and year.

For example:

- If your DOB is 23 April 1998, then the password of the PDF is 23041998.

- If your DOB is 20 August 2000, then the password of the PDF is 20082000.

For safety reasons, the PDF of your e-PAN card is always locked by a password.

5) FAQs

- Can I download e-PAN card without OTP from e-Filling portal?

No, to secure your documents from misuse, it is OTP protected. You can’t download the PDF of your e-PAN card without the Aadhaar OTP, which you will receive on your Aadhaar-linked number.

- My PAN card is misplaced and I don’t know my PAN number. Can I download e-PAN Card?

No, you can not download the PDF of your e-PAN card without entering your PAN card number and details.